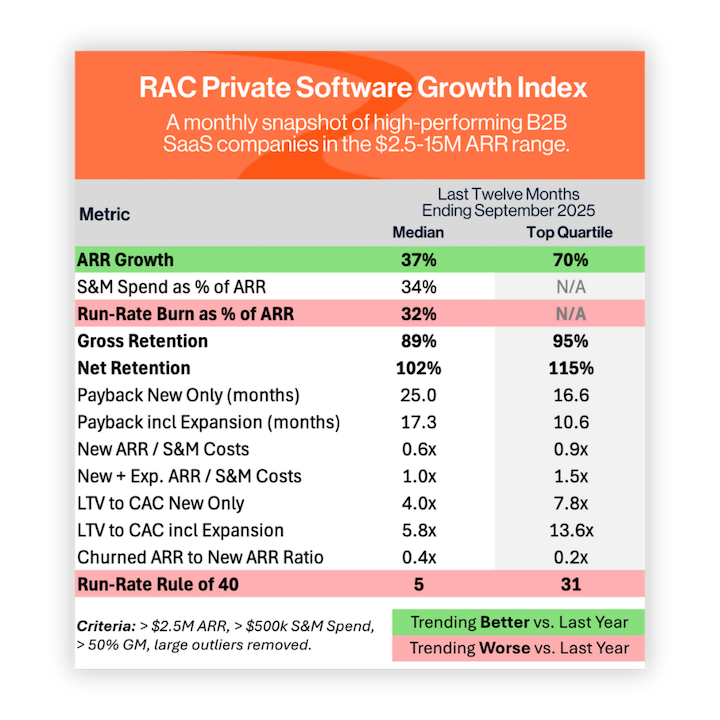

Every year, we have the privilege of meeting with hundreds of software companies, many of them in our ‘sweet spot’ of $2.5-15 million in annual revenue. From those conversations and screens, we’ve assembled the RAC Private Software Growth Index, a set of key performance indicators aggregated across the 400+ companies we’ve reviewed in detail.

We update this Index each month on a rolling Last Twelve Month basis and use it as a benchmark to help drive priorities within our portfolio, and we hope you’ll find it useful as well. The data set is distinctive as it comes from data calculated directly from a company’s financial statements and exclusively tracks growth-stage, business-to-business software companies.

Here's what's that Index looks like for last month:

To learn more about the Private Software Growth Index and how it was constructed, please see the disclosure at the bottom of this post.

What stands out in the data?

We’re pleased to see annual recurring revenue (ARR) growth rates accelerate, continuing a trend we’ve observed over the last few months. Both the median and top quartile growth rates are also higher than they were a year ago. Meanwhile, gross and net retention rates remain strong and have barely budged from one year ago, suggesting that software remains as sticky as ever, at least for now.

Burn has continued to inch up, driven mostly by increased investment in product and engineering. This is a trend we’ve been tracking since May, and it’s become clearer that it’s almost certainly the result of product refreshes as companies invest in new artificial intelligence (AI) features. To better capture some of that impact, we’ve added the Rule of 40 to our Index, which we’ve been tracking internally for years. The generally accepted ‘rule of thumb’ is that a healthy software company’s combined revenue growth rate and profit margin should equal or exceed 40%. It's interesting to see that the top-quartile ‘rule of 40’ comes in at 31% this month, no longer >40 (it was 41% this time last year...).

The big question: Will these AI product investments drive future growth and margins? Or does the imperative to continuously innovate mean "Rule of 30" is the new “Rule of 40”? We’d love to hear your thoughts.

Interested in receiving the data straight to your inbox each month?

Subscribe to our ‘Off The RAC’ newsletter for our monthly Private Software Growth Index, along with highlights from across RAC and our portfolio companies.