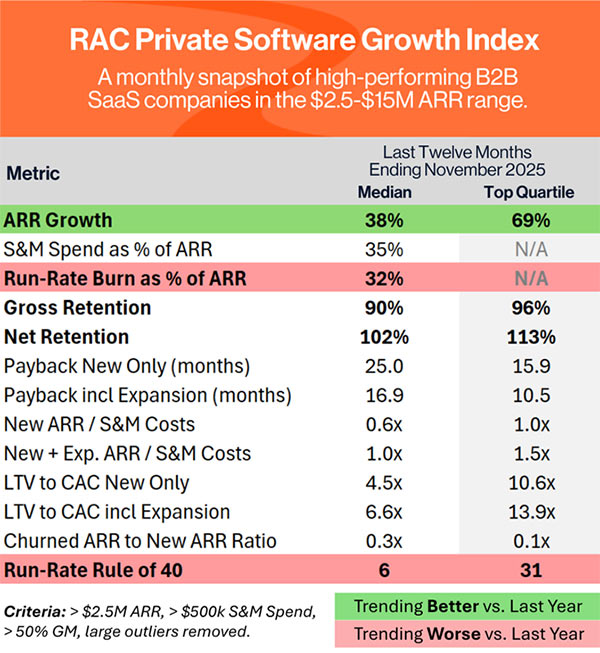

RAC’s Private Software Growth Index: November 2025

Every year, we have the privilege of meeting with hundreds of software companies, many of them in our ‘sweet spot’ of $2.5-$15 million in annual revenue. From those conversations and screens, we’ve assembled the RAC Private Software Growth Index, a set of key performance indicators aggregated across the 400+ companies we’ve reviewed in detail.

We update this Index each month on a rolling Last Twelve Month basis and use it as a benchmark to help drive priorities within our portfolio, and we hope you’ll find it useful as well. The data set is differentiated as it comes from data calculated directly from a company’s financial statements and exclusively tracks growth-stage, business-to-business software companies.

Here's what's that Index looks like for last month:

To learn more about the Private Software Growth Index and how it was constructed, please see the disclosure at the bottom of this post.

What stands out in the data?

Growth in the Private Software Growth Index remains quite strong, with the median growth rate at 38%, and top quartile at a healthy 69%. Both figures are higher compared to the year before (meaning that software growth is continuing to accelerate).

Retention is also trending higher compared to last year, with the median gross retention rate now at 90%, and median net retention at 102%.

Spending on Sales & Marketing is up only marginally across the Index, but total burn is up materially compared to last year. This continues a trend we have seen the past few quarters, with higher burn coming from increased spending in product and R&D (rather than GTM).

The big question: Recently, we have been working with several vertical software companies in our portfolio that are implementing new product-led growth initiatives, in product areas that historically would have only been suitable for a traditional enterprise sales model. Are AI advancements around marketing, implementation, and onboarding making a PLG sales motion more viable, in more situations, than it might have been in the past? Could these types of initiatives be a key driver of the increased product investment we're seeing in the numbers below? We'd love to hear your thoughts.

Interested in receiving the data straight to your inbox each month?

Subscribe to our ‘Off The RAC’ newsletter for our monthly Private Software Growth Index, along with highlights from across RAC and our portfolio companies.

We love meeting new software companies, so let's talk.