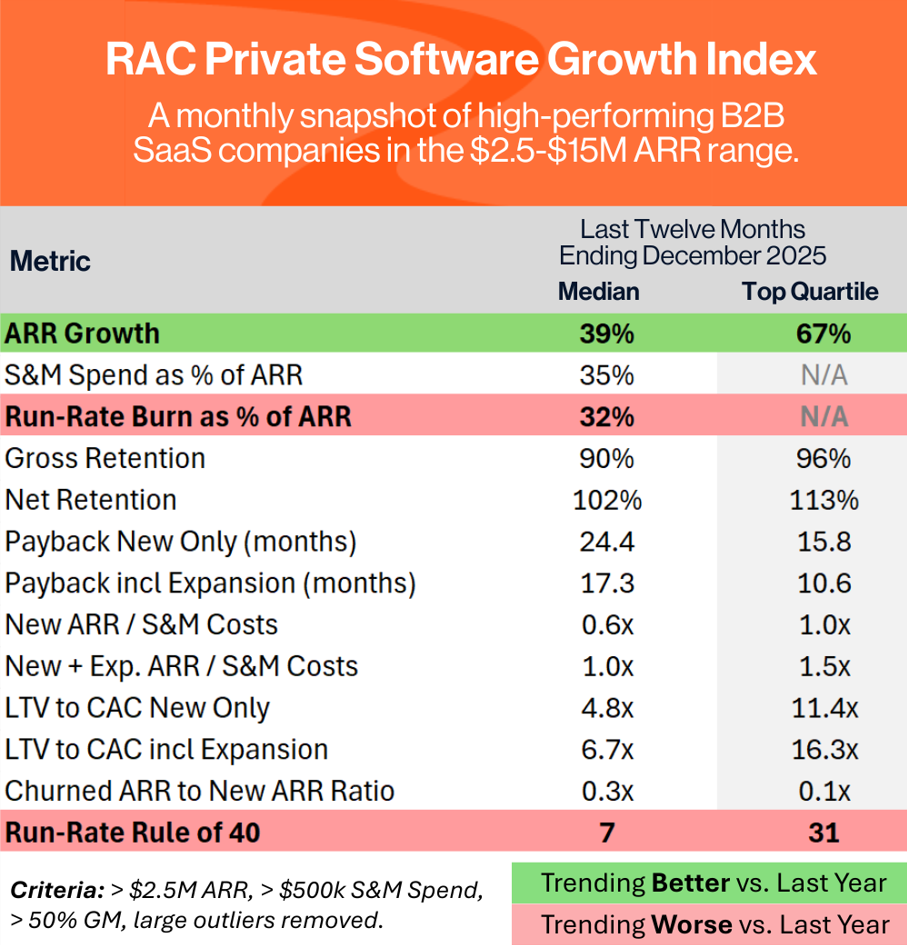

RAC’s Private Software Growth Index: December 2025

Every year, we have the privilege of meeting with hundreds of software companies, many of them in our ‘sweet spot’ of $2.5-$15 million in annual revenue. From those conversations and screens, we’ve assembled the RAC Private Software Growth Index, a set of key performance indicators aggregated across the 400+ companies we’ve reviewed in detail.

We update this Index each month on a rolling Last Twelve Month basis and use it as a benchmark to help drive priorities within our portfolio, and we hope you’ll find it useful as well. The data set is differentiated as it comes from data calculated directly from a company’s financial statements and exclusively tracks growth-stage, business-to-business software companies.

Here's what's that Index looks like for last month:

To learn more about the Private Software Growth Index and how it was constructed, please see the disclosure at the bottom of this post.

What stands out in the data?

Growth in the Private Software Growth Index remains strong, with the median growth rate at 39%, and the top quartile growth rate at 67%. We consider these to be very healthy numbers, which are even higher than they were last year (meaning that growth is accelerating in the Index).

Interestingly, if you look at each of the most closely tracked SaaS metrics—growth, gross retention, net retention, payback periods—all are showing continued improvement compared to last year...with the notable exception of burn. According to our data, companies appear to be getting stronger growth from increased investment in product/R&D (as opposed to increased investment in S&M), which is negatively impacting burn and rule-of-40.

The big question: We also noted that gross margin improved by two percentage points compared to the same period last year. Could this be from the impact of AI tools being applied to the areas of customer service and support? This is a frequent topic in our board meetings recently, and we would love to hear about your own innovations in this area.

Interested in receiving the data straight to your inbox each month?

Subscribe to our ‘Off The RAC’ newsletter for our monthly Private Software Growth Index, along with highlights from across RAC and our portfolio companies.

We love meeting new software companies, so let's talk.