5 Tips for Growth-Stage Executive Compensation

For founders of software companies, transitioning from early to growth stage often comes with a few growing pains.

When you reach a point where you can no longer grow the company on your own, it’s time to turn your attention to acquiring and retaining the right executive team — a step in a startup’s evolution that can pose significant challenges as well as opportunities.

In an early-stage, founder-led SaaS business, the CEO typically pays themselves and others only what the company can afford. But this changes as the company scales.

As a business enters the growth stage, the focus turns to hiring seasoned executives. And while assembling a high-quality team is critical for any business, failure to do so in a growth-stage company can have make-or-break consequences.

Adopting a competitive executive compensation program is a key step toward attracting top executive talent. Think of it as an investment in future growth and value creation.

To hire the best executive talent, retain them, and incentivize their performance in order to prosper, consider these five best practices:

1. Align Your Compensation Plan Around Key Metrics

Executive compensation plans should be built around the metrics that are most critical to the business. In more mature companies, that standard may be a combination of revenue and EBITDA.

But for growth-focused SaaS companies, the three most critical metrics are:

- Annual Recurring Revenue (ARR) generated from new business

- ARR generated from up-sell and cross-sell opportunities through existing customers

- Retention and renewals

From these three key metrics, simplify and distill them into one: Net Bookings — a figure calculated by adding the three metrics together and then subtracting ARR lost from churn or down-sell.

The equation looks like this:

Net Bookings = [ ARR from new business + new ARR from up-sell + new ARR from cross-sell] – [ARR lost from churn + ARR lost from down-sell]

By aggregating these metrics into one, you prioritize the need for strong ARR balanced with a mandate for laser focus on customer success across the organization.

2. Build Team Buy-In and Bonus Structure Around Shared Goals

While each executive on your team will have his or her own area of focus, financial performance is objective number one for the senior leadership team. As such, each member of your team should be working together toward the same goals, and your executive compensation package should be built to incentivize those goals.

For example, if sales is focused solely on customer acquisition but not on the right ideal customer profile, the entire organization may suffer when there’s an uptick in customer churn.

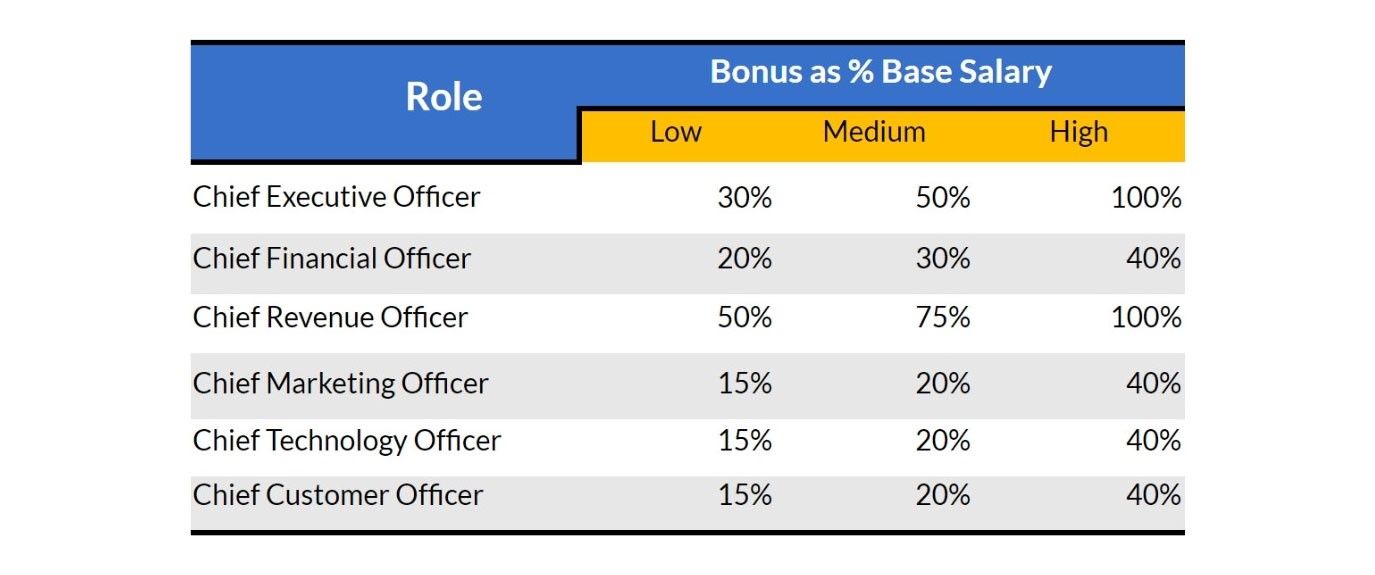

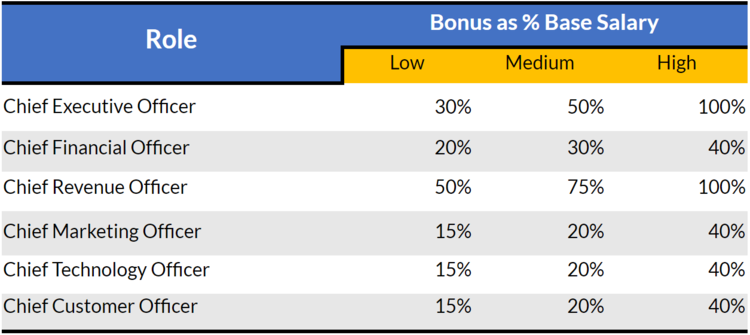

Once your team is working from the same playbook, build out a bonus structure (as a percentage of base salary) that incentivizes performance. See the bonus structure diagram below, noting that the low, medium, or high percentage reflects the depth of an executive’s experience.

3. Adopt a Guard-Rail Payout Structure

Now that you’ve aligned your compensation plan to key metrics and shared goals, you can create a payout structure with performance parameters that are realistic and achievable.

Bonuses should be tied to net bookings, as already mentioned, but to incentivize good stewardship of your company’s capital, you need a “check and balance” on how much money you spend pursuing the planned growth. To discourage your team from overspending, consider creating a guard rail.

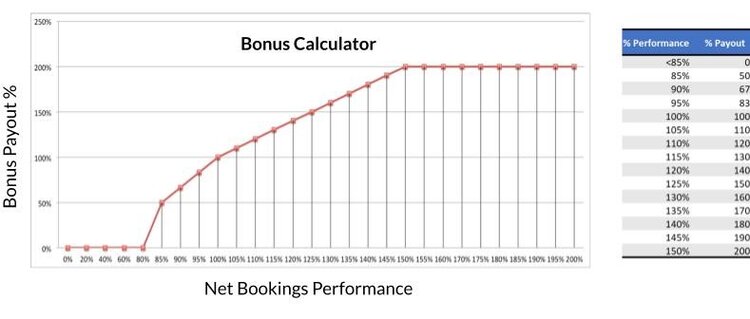

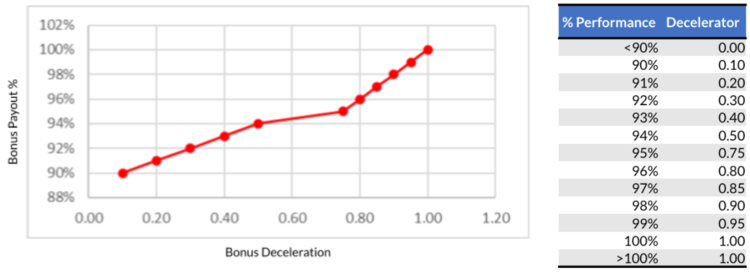

Additionally, bonuses should be foregone if key metrics are missed by more than 15 percent, whereas over-performance should be rewarded. The following diagram is an example of how bonuses might be calculated vis a vis established performance metrics and what deceleration rates, or penalty, might be applied for overspending.

Lastly, keep in mind that there should be no bonus incentive for underspending.

Here’s an example of how spending deceleration and bonus payout can be implemented:

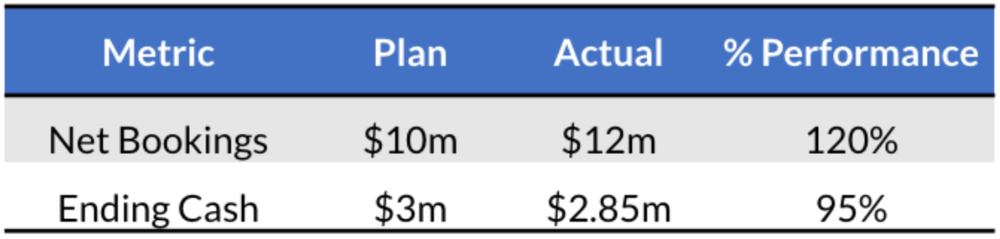

Putting it all together, let’s review how a compensation plan might play out for a growth-stage CMO, who has a base salary of $200,000 and a “medium” bonus option of 20 percent ($40,000) against the following year-end financial metrics.

Based on these metrics, the CMO’s bonus payment for 120 percent of net bookings performance ($40,000 x 1.4) would equal $56,000. Then you would apply .75 deceleration for achieving only 95 percent of ending cash, and the final bonus payment ($56,000 x .75) would be $42,000.

4. Payout Annually, Not Quarterly

While quarterly sales performance is important, it can be accomplished by driving sales at the individual level and reinforced through typical sales compensation plans. In a growth-focused SaaS company, however, quarterly results can be a misleading, knee-jerk metric on which to calculate compensation, leading to excessive payouts in any given quarter, even if the company fails to meet established annual goals by year-end.

A better practice is to adopt annual bonuses that allow your senior leadership team to focus on executing more strategic, longer-term results. Paying bonuses out annually also aids with alignment across the executive team, the board, and your investors.

5. Get Board Approval

Once a formal board of directors is in place, a compensation committee led by an independent director should take ownership of building the plan and present it to the board for approval.

But even before reaching this point, it’s important to demonstrate good governance and, at a minimum, get your board members to review and approve a compensation plan in advance of any roll-out. This will ensure board alignment and prevent any unwelcome surprises when it comes time to pay out bonuses to the team.

Bonus Tip: How to Compensate Your Sales Leader

Sales leaders can be especially tough to satisfy when it comes to their compensation package and may present themselves as a “special case” that warrants a different compensation framework.

One of the ongoing debates is whether to put your vice president of sales on a more typical sales compensation plan or on the same executive compensation plan as other members of the leadership team.

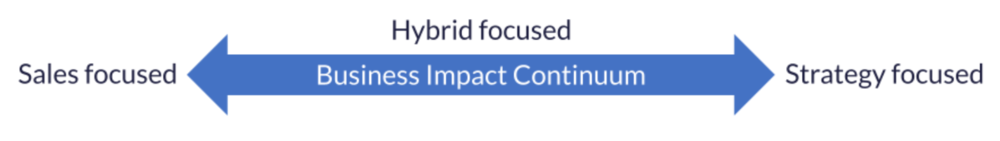

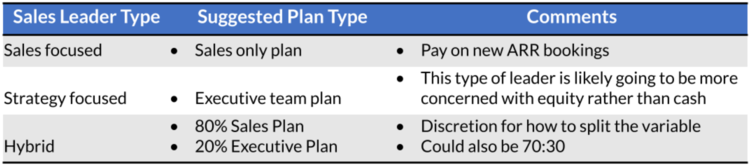

Though frustrating, the answer here is: It depends. That’s because not all sales leaders have the same role and business impact. On the Business Impact Continuum, some are more sales focused while others perform a significant strategy role. Start by identifying where your sales leader falls on the continuum.

- Sales focused describes a sales leader who sits on the executive team but doesn’t contribute to the strategy of the company or maturation of other functions.

- Strategy focused describes a sales leader who actively works with the CEO and members of the leadership team to both set and refine the company strategy over time. This individual is also a key contributor to the development and success of areas in the company they don’t directly oversee.

- Hybrid focused is the most common sales leader at a growth-stage company, both driving day-to-day revenue and contributing to company strategy.

Once you’ve determined what type of sales leader you have, then use this table as a guide to determining their variable compensation:

Finally, it’s important that sales leaders, like the rest of the executive team, have a performance threshold — say 85 percent of established metrics — below which they earn zero. You want to avoid a situation in which your head of sales is earning their variable compensation while the rest of the leadership team is earning nothing.

Great Leaders: Your Bridge to Achievement

As you transition from an early to growth-stage startup, building a skillful, impactful executive team should be seen as an investment in your business — just like any other asset.

By developing a compensation strategy that aligns your overall goals and growth objectives to each executive’s personal financial gain, you’ll be able to attract and retain leaders who will think big, manage effectively, and help you achieve your established business goals.

We love meeting new software companies, so let's talk.